The private sector is a driver of growth. However, African firms, regardless their size, suffer from a lack of financing, especially in areas where traditional financing solutions are insufficient. Could…

The private sector is a driver of growth. However, African firms, regardless their size, suffer from a lack of financing, especially in areas where traditional financing solutions are insufficient. Could impact investing be a possible alternative?

Companies – large, medium, small – are one of the main sources of economic growth, as they actively participate in job creation, generate income and contribute positively to social and environmental well-being. However, the private sector in Africa faces significant financing gap, especially in areas where traditional financing solutions as banking credit are lacking. This is where impact investing emerges as a promising alternative, particularly for companies having important externalities for their communities.

Impact investing, an unknown financing solution

Impact investing is seen as a recent alternative to finance the private sector, particularly for firms and projects that generate substantial extra-financial benefits for their communities. Impact investing vehicles have grown by double digits (14%) in five years (2017-2022) in Africa, but it still remains a less developed segment compared to other forms of financing. There is a real enthusiasm around this financial innovation, particularly from donors and governments. Despite this interest, this recent financing solution remains largely unknown. In a recent study, the FERDI, through its Impact Investing Chair, aims to improve the understanding of this industry in Africa by publishing an analytical mapping of impact investing on the African continent.

Specificities and role in development financing

Impact investing mobilizes financial traditional tools such as debt or equity. Its specificity lies in directing its funds towards firms and projects that generate high extra-financial impacts, whether economic (e.g., creation of jobs, direct and indirect ones), social (e.g., improvement of healthcare services), or environmental (e.g., providing renewable energy solutions). It also targets investees that cannot qualify for traditional financing channels, such as bank loans, due to their unfavorable risk-return balance.

Impact investors play a crucial role in bridging the financing gap for many companies in Africa. They take the risk of investing in these latter at various stages of their development, despite a potential lower return than market rates. The trade-off for this reduced profitability and increased risk is that the provided investments will generate significant community impacts. This financing helps entrepreneurs launch their projects, develop their products, strengthen their market strategies, and become self-sufficient on a long-term run. A notable example is the Laiterie du Berger (LDB), a Senegalese dairy company that has been supported financially by the impact investor I&P. With over 700,000 euros invested over several years, I&P supported LDB from its early stages, despite modest initial profits – impact investors often use patient capital. Other impact investors subsequently provided financial support for its development. Today, LDB employs more than a thousand people and contributes to improving the agricultural value chain, nutrition, incomes, and Senegal’s GDP – demonstrating the importance of impact investing and its actors in development financing.

Some data on impact investors in Africa

On the African continent, impact generation goals are often based on the ability to achieve the Sustainable Development Goals (SDGs), and contribute to the national development plans of the countries in which they invest, which may not be the case elsewhere. Therefore, investees’ economic activities are often tightly linked to one or most of the seventeen SDGs.

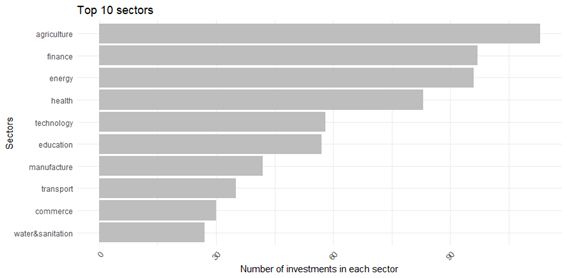

Moreover, given their dual objective – impact and financial return – impact investors seek to finance sectors that allow them to attain scalability and an acceptable financial return. This is why their investments in Africa are concentrated in agriculture, finance, and energy. These three sectors meet this dual constraint. They are among the fastest-growing sectors on the continent and also employ the most workforces.

For instance, the agricultural sector is crucial both economically, by employing more than half of the active population in Africa (51.71% of jobs on the continent are in agriculture, World Development Indicator); socially, due to rural poverty; and environmentally as agriculture is both a recipient and a solution to environmental challenges (climate change, biodiversity, pollution).

Nevertheless, the mapping conducted by the FERDI’s Impact Investing Chair shows that the majority of investment funds operating in Africa are headquartered outside the continent, mainly in North America and Europe. African impact funds represent barely more than 16% of the activity of funds operating on the continent, with a notable concentration in a few english-speaking countries such as Nigeria, Kenya, and South Africa. These countries are also where most of the investees are located.

The landscape of impact investing in Africa is also dominated by medium-sized funds (from 1 to 250 million USD), which constitute 54.5% of identified impact investors on the continent. However, 80% of the assets under management mobilized in Africa, amounting to 108 billion USD, are managed by a few mega-funds (over 1,000 million USD) – representing 7% of investors, with only three out of eighteen headquartered in Africa (in Nigeria and Mauritius), the rest being mostly European.

Impact investing challenges in Africa

Impact investing in Africa faces several challenges.

Firstly, the disconnection between the nationality of the funds and the country and companies they invest in is a source of challenges for investors on the African continent. Investing in the local currency of the investees’ market or in the investors’ currency presents a dilemma, often leading to a “currency mismatch.” Currency market shocks can be a blocking factor for fund allocation and can be an argument for withdrawal by capital providers and local financial institutions.

The difficulty in measuring and demonstrating the real net impact of these investments is also a major challenge for this sector in Africa. Indeed, its economic impacts are higher than what data can show – as in the case of LDB.

However, it is indeed essential for impact investors to demonstrate their community impacts to build their legitimacy and credibility among capital allocators, who are mainly foundations and development finance institutions (DFIs). The lack of qualified personnel and the high cost of evaluation systems partly explain that difficulty to prove their credibility to these entities to support their fundraising efforts. The administrative burden linked to fundraising is also one of the reasons for the decline in the creation of new funds since the beginning of the century. This human resource issue is explained by the competitive labor market. Impact investors face competition from competitors like DFIs and development agencies that offer higher salary ranges, making it challenging for them to meet these standards.

Another challenge is the difficulty of exit due to the limited size of the local impact investing ecosystem. Few investors, whether international or national, are interested in buying their shares. The sale of these shares can thus be prolonged beyond the initially defined maturity, serving as a deterrent for impact investors themselves.

To conclude, in order to fully realize the potential of impact investing, it is essential to increase the financing of local actors by simplifying procedures and innovating to attract institutional investors. Supporting its development by implementing mechanisms to improve the risk-return balance, notably through the development of specific instruments and secondary markets, would leverage the emergence of this sector. Finally, it is important to improve the quality of funds and their impact measurement methodologies by supporting teams, sharing best practices, and implementing dedicated incentives. The FERDI Impact Investment Chair addresses these issues in its current research agenda.